Mumbai, the City of Dreams, is known for its bustling lifestyle, thriving economy, and, most notably, its sky-high real estate prices. For investors looking to tap into the city’s lucrative property market, understanding rental yield becomes crucial. Rental yield is a key metric for gauging the profitability of a property, especially in a city like Mumbai, where property prices and rental income can vary significantly based on location, property type, and demand.

In this blog, we will dive into the concept of rental yield, its importance, and how it plays out in different areas of Mumbai’s diverse property market. Whether you’re an investor looking for high returns or a homeowner contemplating renting out your property, this guide will provide you with the insights needed to navigate Mumbai’s rental landscape.

Understanding Rental Yield

Rental yield refers to the annual income generated from a rental property as a percentage of its market value. In simple terms, it’s a measure of how much return on investment (ROI) you’re getting from the rent collected, relative to the property’s current market price.

Types of Rental Yield:

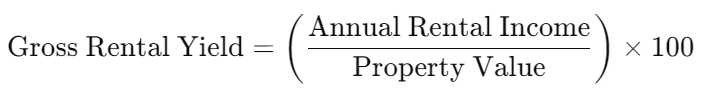

- Gross Rental Yield: This is the simplest form of rental yield and can be calculated by dividing the annual rental income by the property’s purchase price. The formula is:

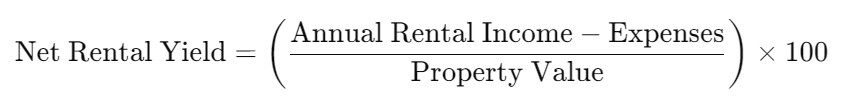

- Net Rental Yield: This is a more accurate measure, as it takes into account the various expenses incurred in maintaining the property. These expenses can include property taxes, maintenance, repairs, insurance, and other costs associated with property management. The formula is:

The net yield is more reflective of actual returns since it factors in the costs that reduce rental income.

Why is Rental Yield Important?

For any real estate investor, understanding rental yield is crucial to determining whether a property will generate sufficient returns. Here’s why:

- Profitability Measurement: Rental yield offers a clear picture of the return on investment. A property with a high rental yield indicates a profitable venture, while a lower yield might signal poor returns or high holding costs.

- Market Insights: By comparing rental yields across different locations, you can gauge which neighborhoods or areas provide better returns. In a market as dynamic as Mumbai, this is invaluable for making informed decisions.

- Cash Flow Forecasting: Rental yield helps in estimating future cash flow, which is essential for assessing whether the rental income will cover mortgage payments, maintenance costs, and other obligations.

- Risk Management: Lower rental yields could indicate higher risks in terms of vacancy rates, maintenance issues, or falling property prices. By understanding rental yield, you can manage risks more effectively and make strategic investment decisions.

Factors Influencing Rental Yield in Mumbai

Mumbai’s property market is diverse and complex, with rental yields varying greatly depending on several factors:

1. Location:

Location is perhaps the most significant factor affecting rental yields in Mumbai. Properties in prime areas like South Mumbai (Colaba, Cuffe Parade, Marine Drive) tend to have higher property prices but lower rental yields due to the premium attached to ownership. In contrast, suburban areas like Thane, Navi Mumbai, and Mulund often offer more affordable property prices with relatively higher rental yields.

Example:

- South Mumbai property: ₹5 Crore, Monthly Rent: ₹1.5 Lakh

- Gross Rental Yield: 3.6%

- Mulund property: ₹1.5 Crore, Monthly Rent: ₹40,000

- Gross Rental Yield: 3.2%

While both properties offer similar yields, the initial capital investment is much lower in Mulund.

2. Property Type:

- Residential vs. Commercial: Residential properties in Mumbai generally have lower yields compared to commercial properties. The demand for commercial spaces in business hubs like Bandra-Kurla Complex (BKC), Lower Parel, and Andheri East has driven yields higher for office spaces.

- Apartments vs. Standalone Houses: Apartments in multi-story buildings, particularly in gated communities with amenities, tend to attract higher rents than standalone houses, which may have lower demand in the urbanized landscape of Mumbai.

3. Tenant Profile:

The type of tenant you attract—whether it’s a family, expatriate, or corporate—can significantly influence rental yield. Expatriates and corporate tenants often prefer luxury apartments in areas like Worli, Powai, and Bandra, where rental income is much higher, but so are property prices.

4. Connectivity & Infrastructure:

Areas well-connected by Mumbai’s local train network, metro lines, or expressways generally see higher demand for rental properties. Andheri, Ghatkopar, Chembur, and Dadar benefit from excellent transport infrastructure, translating into competitive rental yields. Future infrastructure projects like the Mumbai Trans-Harbour Link or the expansion of metro lines will likely boost yields in nearby areas.

5. Supply and Demand Dynamics:

Rental yields are also influenced by the supply of properties in an area. Localities where there is an oversupply of new developments, such as Kandivali and Mira Road, may witness lower rental yields due to heightened competition. Conversely, areas with limited new supply but high demand, such as Matunga or Parel, may offer better yields.

Best Areas for High Rental Yield in Mumbai

Given the factors influencing rental yields, some areas in Mumbai stand out as particularly favorable for investors seeking better returns. Let’s explore a few:

1. Thane:

Thane is increasingly becoming a hot spot for real estate investment. It offers a mix of residential and commercial developments, along with good infrastructure and connectivity to Mumbai via the Eastern Express Highway. With relatively affordable property prices and rising demand for rentals, Thane boasts rental yields in the range of 3% to 4.5%.

2. Navi Mumbai:

Navi Mumbai is another area offering excellent rental yields. The planned city infrastructure, proximity to commercial hubs, and affordable pricing make it attractive for both tenants and investors. Areas like Vashi, Kharghar, and Seawoods offer yields ranging from 3.5% to 5%.

3. Powai:

Powai is a well-established residential and commercial hub that attracts high-earning tenants, particularly in the IT and corporate sectors. The presence of leading companies, educational institutions, and upscale living options pushes yields in this area to 3% to 4%, despite high property prices.

4. Chembur:

Well-connected to both central and western suburbs, Chembur offers mid-range property prices with strong rental demand. Yields in Chembur hover around 3% to 4%, and the area is expected to benefit from upcoming infrastructure projects, potentially boosting yields further.

5. Bandra-Kurla Complex (BKC):

Known as the city’s premier commercial district, BKC offers high rental yields in the commercial property segment, often exceeding 6%. Even for residential properties, BKC yields remain strong due to high demand from corporate professionals and expatriates.

Challenges in Maximizing Rental Yield

While Mumbai’s property market offers significant opportunities for rental income, there are challenges to maximizing rental yield:

- High Property Prices: The high capital investment required in prime locations like South Mumbai often leads to lower rental yields, as rental income does not scale proportionally with property value.

- Regulatory and Legal Issues: Navigating rental laws in India can be complex. Issues like tenant eviction laws, rent control regulations, and compliance with tax laws can impact profitability.

- Vacancy Risks: In high-end areas, properties may remain vacant for extended periods if rental demand softens or if rents are set too high. This can result in lost rental income, significantly lowering the effective yield.

- Maintenance Costs: Properties in Mumbai often require high maintenance costs due to aging infrastructure, weather conditions (e.g., monsoons), and general wear and tear. These expenses can cut into rental income, reducing net rental yield.

Tips to Improve Rental Yield in Mumbai

- Invest in Emerging Suburbs: Instead of focusing on saturated prime areas, consider investing in emerging suburbs like Mira Road, Virar, or Panvel, where property prices are lower and rental demand is growing.

- Upgrade Your Property: Simple improvements like modern fittings, good interiors, and maintenance can help command higher rents, especially in mid-range localities.

- Optimize Rent: Keep rents competitive, especially in areas where vacancy risks are higher. Offering a slightly lower rent can ensure a steady flow of tenants, improving overall yield.

- Leverage Corporate Rentals: If your property is located near commercial hubs or business districts, consider renting to corporate clients, who are often willing to pay a premium for well-located, fully-furnished properties.

Conclusion

Mumbai’s rental market offers immense potential for savvy investors, but understanding rental yield is essential for making informed decisions. While prime locations may offer prestige, emerging suburbs and well-connected areas provide better rental yields. By carefully analyzing factors such as location, tenant profile, and property type, investors can maximize returns on their investments in Mumbai’s dynamic real estate landscape.

Whether you’re a first-time investor or a seasoned landlord, focusing on rental yield is the key to unlocking long-term profitability in Mumbai’s ever-evolving property market.